Table Of Content

The good news is that, despite elevated rates, there are methods you can employ to secure a lower rate. These methods might be especially beneficial if you bought a home between mid-October and early November 2022 or mid-August through early December 2023 when rates were over 7%. Here’s how refinance activity has trended recently, according to the MBA’s Weekly Mortgage Applications Survey. Even so, Cohn expects the Fed to start cutting rates in June or July.

Mortgage Rates Stay High Amid Inflation Fears - Bankrate.com

Mortgage Rates Stay High Amid Inflation Fears.

Posted: Wed, 24 Apr 2024 20:03:45 GMT [source]

When should you lock in your mortgage rate?

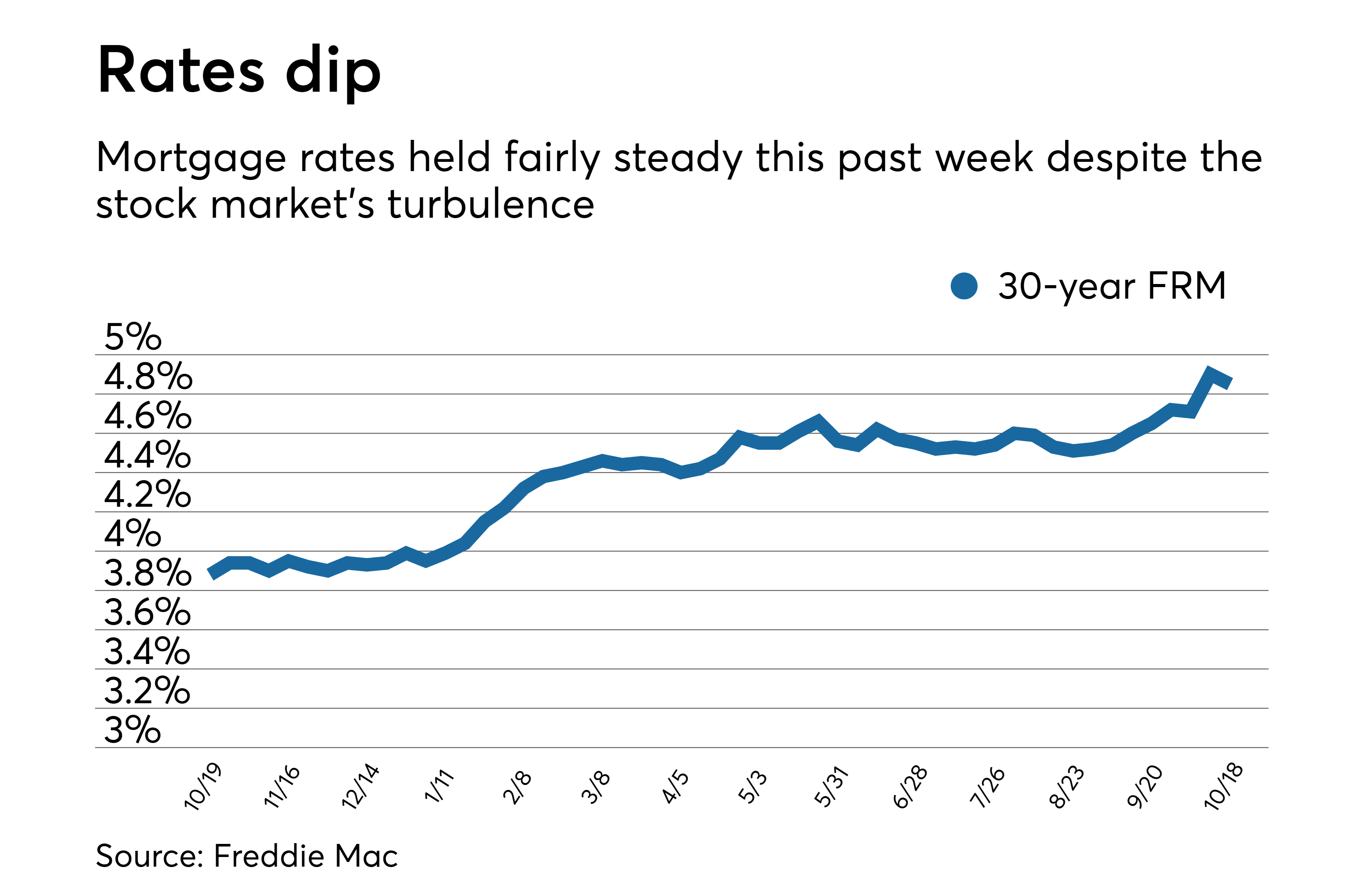

This would be the first cut since the Fed slashed rates in the early days of the Covid-19 pandemic, although most experts don’t expect to see it happening until some point in the spring. With inflation running ultra-hot, mortgage interest rates surged to their highest levels since 2002. According to Freddie Mac’s records, the average 30-year rate jumped from 3.22% in January to a high of 7.08% at the end of October. Mortgage interest rates fell to historic lows in 2020 and 2021 during the Covid pandemic. Emergency actions by the Federal Reserve helped push mortgage rates below 3% and kept them there.

U.S. Economy

We do not include the universe of companies or financial offers that may be available to you. You can check rates online or call lenders to get their current average rates. You’ll also want to compare lender fees, as some lenders charge more than others to process your loan. Federal Reserve raises its interest rate target for overnight lending between banks, and interest rates throughout the financial sector typically follow suit.

How Do Fed Rate Hikes Affect Mortgages?

The APR is based on the interest rate and includes mortgage origination fees and discount points to indicate all of the costs of getting the loan. A 30-year fixed-rate mortgage is by far the most popular home loan type, and for good reason. This home loan has relatively low monthly payments that stay the same over the 30-year period, compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage. If you prefer predictable, steady monthly payments, a 30-year fixed-rate mortgage might be a great option. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI).

Home insurance

If you’re interested in taking out a mortgage, Channel’s advice is to focus on what you can afford in the current market. It’s impossible to time the market but, ultimately, if you take on a mortgage with affordable payments, you can succeed in any market. Average 30-year fixed mortgage rates nearly reached 8% in the second half of 2023, but finally fell below 7% in mid-December.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. In QE, the Federal Reserve purchases longer-term securities from the open market in order to encourage lending and investment by increasing the money supply. In addition, this strategy of bidding up fixed-income securities also serves to lower interest rates. Once you’ve selected your lender, you should ask your loan officer about the options you have to lock in a rate. Mortgage rate locks usually last between 30 and 60 days, and they exist to give you a guarantee that the rate your lender offered you will still be available when you actually close on the loan.

Today’s Mortgage Interest Rates by Term

If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. If you want to pay off a 30-year fixed-rate mortgage faster or lower your interest rate, you may consider refinancing to a shorter term loan or a new 30-year mortgage with a lower rate.

California conforming loans

You could save thousands of dollars through the life of the loan. For the average homebuyer, tracking mortgage rates helps reveal trends. But not every borrower will benefit equally from today’s competitive mortgage rates. Thanks to sharp inflation growth, higher benchmark rates, and a drawback on mortgage stimulus by the Fed, mortgage rates spiked in 2022. CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them.

A teaser rate is a lower initial rate offered on a mortgage loan for a set time period before the actual fixed mortgage rate goes into effect. Teaser rates are often obtained through an adjustable-rate mortgage (ARM) loan, that have 3-, 5- or 7-year options. Lenders measure your debt-to-income (DTI) ratio by dividing your total monthly debt by your before-tax income. A debt consolidation calculator can estimate how much a debt consolidation loan could lower your monthly payments. Keep in mind, the 30-year mortgage may have a higher interest rate than the 15-year mortgage, meaning you'll pay more interest over time since you're likely making payments over a longer period of time. Additionally, spreading the principal payments over 30 years means you'll build equity at a slower pace than with a shorter term loan.

Though mortgage rates and home prices are high, the housing market won’t be unaffordable forever. It’s always a good time to save for a down payment and improve your credit score to help you secure a competitive mortgage rate when the time is right. Mortgage rates change daily, but average rates have been moving between 6.5% and 7.5% since late last fall. Today’s homebuyers have less room in their budget to afford the cost of a home due to elevated mortgage rates and steep home prices.

Today's 15-year and 30-year mortgage rates rise April 26, 2024 - Fox Business

Today's 15-year and 30-year mortgage rates rise April 26, 2024.

Posted: Fri, 26 Apr 2024 13:15:40 GMT [source]

Loan limits change annually and are specific to the local market. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Be sure to ask your lender about the consequences of not closing within the timeframe specified in a rate lock agreement and also about what could happen if rates fall after you lock in a rate.

That tradeoff needs to take into account how long you see yourself in the home and mortgage. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Adjust the graph below to see 30-year mortgage rate trends tailored to your loan program, credit score, down payment and location. At the current average rate, you'll pay $685.57 per month in principal and interest for every $100,000 you borrow. The average 30-year fixed-refinance rate is 7.30 percent, up 23 basis points over the last seven days. A month ago, the average rate on a 30-year fixed refinance was lower at 6.91 percent.

That’s an increase of nearly 400 basis points (4%) in ten months. Current rates are more than double their all-time low of 2.65% (reached in January 2021). But if we take a step back and look at rates over the long term, they’re still close to the historic average.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Though lenders decide your mortgage rate, there are some proactive steps you can take to ensure the best rate possible. For example, advanced preparation and meeting with multiple lenders can go a long way. Even lowering your rate by a few basis points can save you money in the long run. To help you find the right one for your needs, use this tool to compare lenders based on a variety of factors.

No comments:

Post a Comment